MPO Pointer 10/24 August 2020

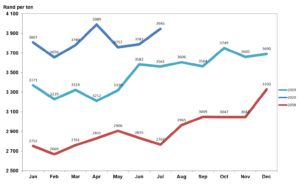

The graph below clearly illustrates the rise in the concentrates portion of feed costs (30% soya and 70% yellow maize) from 2018 to July 2020, based on SAFEX prices. The current level of the yellow maize price in particular is supported by export parity, which is neutralising the expected effect of the big maize crop. Milk purchasers who expected that the large maize harvest would lead to the availability of inexpensive unprocessed milk will have to revise their expectations urgently.

Source: JSE, Commodity derivatives, 30% soya and 70% yellow maize

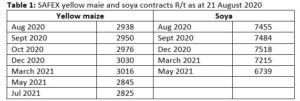

The table below shows the prices of futures contracts on SAFEX; it is clear that current prices will remain in place for the future and may even show further increases. Market players, therefore, expect that both yellow maize and soya prices will receive strong support from export parity and that the prices will remain high despite the large harvest. Recent grain imports by China have supported international prices and the directive by the Chinese president known as the ‘Clean Plate Campaign’ to counteract food waste has caused international commodity dealers to question whether food security in China is under pressure.

Table 1: SAFEX yellow maie and soya contracts R/t as at 21 August 2020

Source: JSE, Commodity derivatives

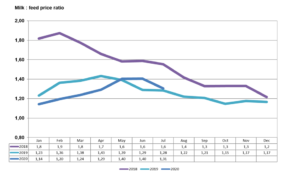

The higher grain prices immediatlely forced the milk-to-feed price ratio down to 1,3:1, which means that there is no margin left for most dairy farmers. This will immediately inhibit the dairy producer’s ability to achieve optimal production and to apply beneficial labour and resource conservation practices.

Source: SAFEX and MPO calculation

To summarise

In last week’s MPO Pointer (9), it was indicated, after a market analysis, that sufficient margins are present lower down in the value chain, at least to maintain current producer prices. Unfortunately, certain milk purchasers have already reduced their prices and others have indicated that they will reduce their prices at the end of August. Against the background of the above and the facts reflected in MPO Pointer (9), there are grounds for a price increase rather than a price reduction. The MPO is planning to hold wide-ranging talks this week with milk purchasers to discuss the present state of affairs. The MPO is committed to influencing the debate concerning prices in the value chain objectively and dynamically on the basis of accurate economic facts and in the interests of the entire value chain. We intend to exhaust this avenue before we approach other structures.

Bertus van Heerden, chief economist, Milk Producers’ Organisation (MPO)

Published on Monday, 24th August 2020 - 17:07

Recent Posts

disclaimer